Integrated UAE E-Invoicing Solution: Bridging SAP ERPs to Accredited Service Providers

Navigate the new UAE e-invoicing mandate with confidence. As a leading e-invoicing solution provider in UAE, Exalogic Consulting delivers the best e-invoicing software to bridge the gap between your SAP ERP and the FTA. Our enterprise e-invoicing UAE platform ensures you stay ahead of e-invoicing rules UAE 2026 while automating your entire billing cycle.

SAP DRC: Built-In Compliance for SAP Enterprises

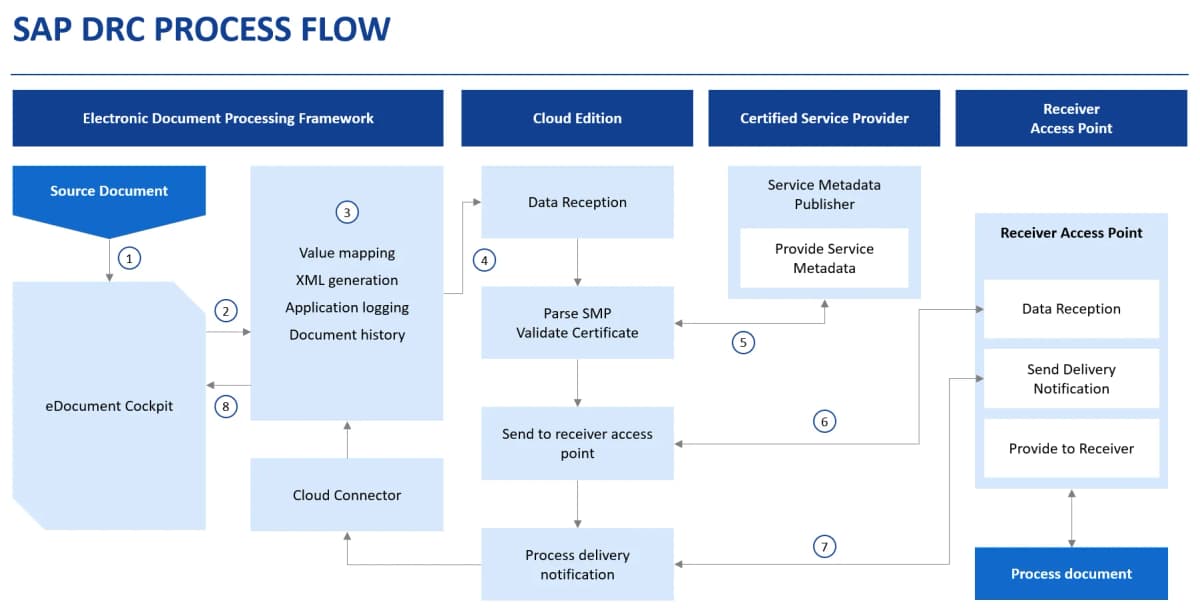

SAP Document and Reporting Compliance (DRC) is SAP’s native framework for country-specific e-invoicing and statutory reporting. For UAE businesses, it enables the generation and validation of invoices aligned with emerging regulatory standards. Exalogic Consulting complements SAP DRC with a compliance bridge that connects SAP to UAE-accredited ASPs, managing PINT-AE mapping, digital signatures, UUID orchestration, and compliant invoice exchange real-time in line with FTA.

How SAP DRC Fits into the UAE E-Invoicing Flow

In a compliant UAE setup, SAP DRC works seamlessly within existing SAP environment:

Invoice creation in SAP (ECC or S/4HANA Public Or Private or On-premise)

Your standard billing or FI processes remain unchanged.

DRC mapping & validation

SAP DRC transforms invoice data into PINT-AE compliant XML and applies FTA-specific validations.

Integration with Accredited Service Providers

Exalogic connects DRC to certified ASPs using secure AS4 protocols under the 5-Corner Model. Exalogic Integrate your ERP system to Cerfitied ASP’s using secure AS4 Protocols by leveraging SAP DRC Component.

FTA acknowledgment & audit logging

Status updates, UUIDs, timestamps, and validation results are stored back in SAP for full traceability.

What We Deliver

This creates a frictionless, secure, and scalable compliance foundation for enterprise finance teams.

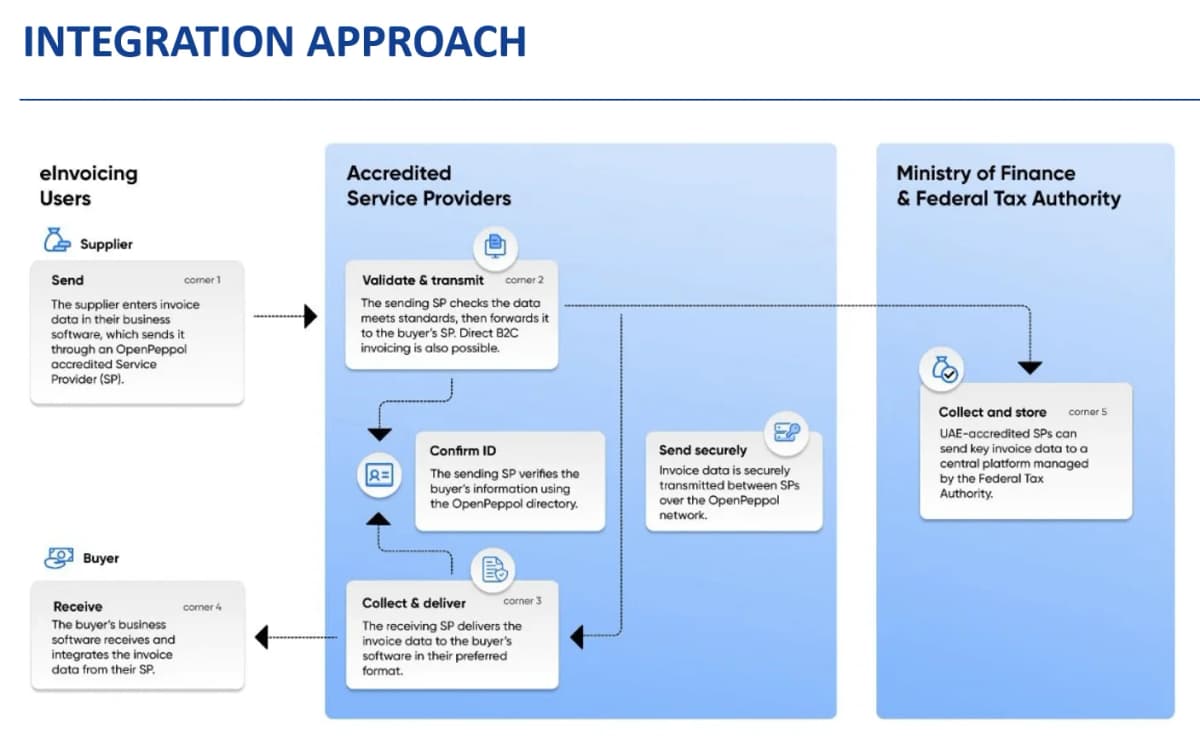

Mastering E-Invoicing in the UAE: Your Path to Seamless Compliance

As part of the UAE 2031 transformative journey towards a fully digital economy, the Ministry of Finance (MoF) and Federal Tax Authority (FTA) have introduced a mandatory UAE e-invoicing framework based on the international Peppol PINT standard. For businesses operating in the UAE, this initiative is more than a regulatory update. It represents a strategic shift to standardised, machine-readable invoicing using the Peppol PINT-AE framework —improving VAT transparency, reducing manual errors, and aligning with international digital trade practices.

Exalogic plays a critical enabling role in this transformation. By leveraging SAP Document and Reporting Compliance (DRC) as the core compliance engine, Exalogic delivers a fully SAP-native e-invoicing architecture tailored for the UAE model. Its compliance bridge integrates SAP seamlessly with UAE-accredited ASPs, operationalizing PINT-AE mappings, validation rules, secure message exchange, and end-to-end audit traceability—without disrupting existing SAP processes.

In effect, Exalogic allows organizations to respond to the UAE e-invoicing mandate not through workarounds or parallel systems, but by embedding compliance directly into SAP’s transactional backbone. What begins as regulatory readiness thus becomes an opportunity for automation, transparency, and scalable finance operations across entities and borders.

Why Leading Enterprises Choose Exalogic for E-Invoicing in UAE?

For Smooth E-invoice integration and Identifying best ASP’s UAE requires a partner that understands both the technical PINT-AE requirements and the complexities of enterprise workflows.

Integrated Compliance

We offer a seamless e-invoicing solution that integrates directly with SAP ERP ensuring you never have to manually upload a file.

PINT-AE Ready

Our platform automatically converts your raw data into the mandatory PINT-AE XML format, complete with required digital signatures and UUIDs.

Transparent Pricing

We understand that e-invoicing software pricing UAE is a key factor in your decision. Our models are scalable, catering to both high-volume enterprises and growth-focused SMEs.

Accredited Network

As one of the leading e-invoicing services in UAE, we operate within the Peppol 5-Corner Model, acting as the secure gateway to the FTA.

Enterprise-Grade Error Intelligence

Context-aware error handling with SAP-level visibility—errors are surfaced in business terms, enabling rapid resolution without technical triage.

Audit by Design (AbD)

Every invoice version, validation outcome, and regulatory response is immutably logged, enabling confident responses to tax audits and statutory inquiries years later.

Minimal Total Cost of Ownership (TCO) and scalability

Architecture aligned to Peppol-based and clearance-adjacent regimes, allowing extension to new UAE phases and other jurisdictions without reimplementation.

SAP Single Source of Truth with Zero-Touch Operational assurance

Compliance data, acknowledgments, and audit artefacts are ferried back into SAP, ensuring SAP remains the single source of truth with no external reconciliation layers. The fully automated processing eliminates manual intervention across the invoice lifecycle, reducing operational risk, rejection rates, and dependency on compliance teams.

UAE e-Invoicing roadmap

The e-Invoicing solution by TaxLab, a pre-approved e-Invoicing service provider in the UAE

prepares systems and data now to meet UAE e-Invoicing deadlines with

Pilot Phase Starts

Selected taxpayers begin e-Invoicing; voluntary adoption also open.

Appoint Approved Service Provider (ASP)

Businesses earning AED 50M must appoint an approved ASP.

Full Implementation Deadline

AED 50M+ businesses must fully implement e-Invoicing to stay compliant.

Smaller Businesses & Government Entities

Smaller businesses and government entities appoint ASPs for transition.

Full Implementation for Smaller Businesses

Smaller businesses must complete e-Invoicing implementation.

Full Implementation for Government Entities

Government entities must fully implement e-Invoicing regulations.

The Exalogic Compliance Workflow:

A 6-Step Roadmap

How to implement e-Invoicing in UAE efficiently?

We’ve distilled the process into six clear steps:

Source Generation

Your SAP ERP creates raw invoice data.

Intelligent Data Capture

Our bridge extracts and validates this data against the FTA "data dictionary".

Pre-Validation & PINT Conversion

The system checks errors and converts data into a compliant XML format.

Secure Handoff to ASP

Invoices are transmitted via the accredited network using AS4 protocols.

Real-Time FTA Clearance

The FTA validates the invoice near-instantly, providing a "Status: FTA Validated" confirmation.

Network Delivery

The validated e-invoice is delivered to the buyer, and the cycle is reconciled automatically.

E-invoicing in the UAE is the catalyst that finally collapses the 'information gap' between a transaction and its reflection on the balance sheet. By moving to real-time validation, CFOs can transform their working capital from a lagging outcome into a strategic instrument. We aren't just looking for compliance; we are looking for a shorter cash conversion cycle and 100% transparency in tax provisioning.

Ganesh Tarimela

SAP Practice Head,

Exalogic Consulting

The biggest hurdle in e-invoicing isn't technology; it's the data quality. Success depends on how well you map your ERP’s master data to the UAE’s PINT-AE Data Dictionary. A robust implementation treats your e-invoicing solution not as a 'plug-in' but as an intelligent bridge that cleanses, validates, and signs every transaction before it ever reaches the FTA.

Athaus Zehran

SAP Solutions Architect,

Exalogic Consulting

Insights & Knowledge Library

Don’t Wait for the Deadline, Secure Your Digital Future Today.

The road to July 2026 is shorter than it looks. Avoid the last-minute rush and the risk of e-invoicing penalties of the UAE. Partner with the experts who understand the nuances of the UAE e-invoicing solution and start your transition with a risk-free consultation.

Let’s build a scalable and resilient digital foundation together.

Take the first step toward a smarter, more efficient business. Contact Exalogic Consulting today for a free consultation and discover how our IT Infrastructure service can drive your growth and scalability.